We use cookies to improve your experience on our website. By continuing you acknowledge cookies are being used.

Investment market review - Quarter-ended 30 September 2025

- Title

- Investment market review - Quarter-ended 30 September 2025

The Research Team provides a performance summary and commentary on each of the five main asset classes.

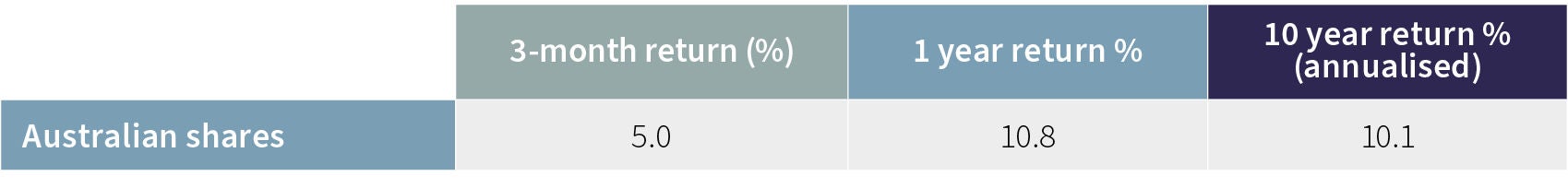

Australian shares

The Australian sharemarket declined modestly in September., with the S&P/ASX 300 Accumulation Index down -0.7%, ending a five-month rally that delivered a 15% gain since March and 5.0% for the quarter.

September saw investor caution emerge as the ASX 200’s current Price to Earnings (P/E) ratio peak near 20x combined with stronger than expected August inflation data. As anticipated, the Reserve Bank of Australia (RBA) kept the cash rate unchanged at 3.6% at its September meeting, acknowledging the likelihood of stronger-than-expected third-quarter inflation. Despite persistent price pressures, markets still anticipate rate cuts ahead, though expectations for timing have been pushed slightly further out.

Over the quarter the sharemarket leadership continued to broaden out, with mid- and small-cap stocks outperforming the broader S&P/ASX index across the quarter supported by the relatively stable economic environment.

From a sector perspective, Materials and Utilities outperformed strongly over the quarter, while Health Care, Consumer Staples, Financials, and Information Technology detracted. Commodity prices rallied in September across gold, silver, copper, and iron ore, driven by safe-haven demand, supply disruptions, and optimism around a potential recovery in China. The S&P/ASX 300 Materials Index advanced 21.2% over quarter. In contrast, CBA continued its retracement from its earlier overvaluation, declining -8.35 over the quarter.

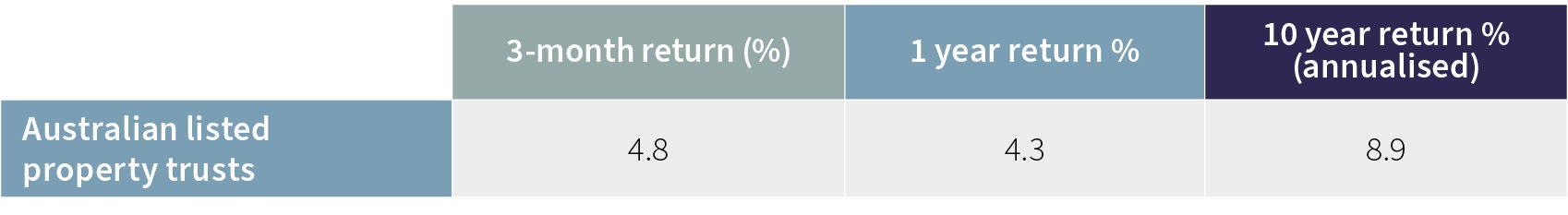

Australian listed property trusts

The Australian Listed Property sector eased in September but delivered a strong 4.8% over the quarter and is up 18.8% over the past 6 months. While the sector faced headwinds from interest rate repricing amid persistent inflation, the broader macro environment remains supportive. Last year revaluations of the underlying property portfolios have also helped provide a more solid foundation for Australian Real Estate Investment Trust (A-REIT) prices and now better reflect the appropriate pricing across office assets.

Global REITs were also solid performers over the quarter with the hedged index delivering 4.3%.

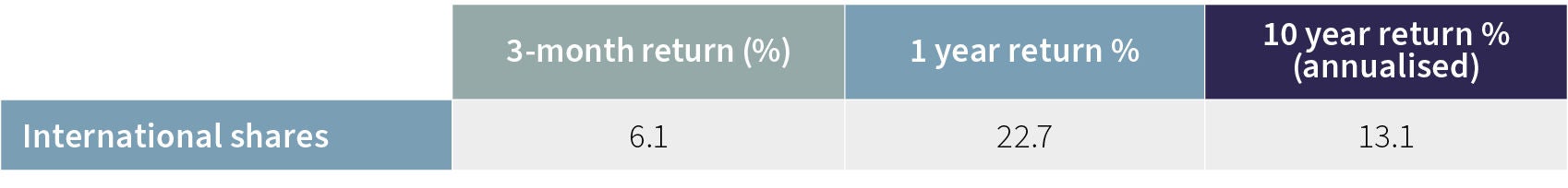

International shares

Global equity markets delivered strong positive returns over the quarter supported by easing trade tensions resilient corporate earnings, AI-driven optimism, and expectations of central bank interest rate cuts.

The benchmark MSCI World Index returned 6.1% for the quarter, and a very strong 22.7% for the year in Australian dollar terms. Performance over the quarter was bolstered by broad-based gains. Emerging markets outperformed developed ones, with the MSCI Emerging Markets Index (AUD) rising 9.4% over the quarter and Global Smaller companies slightly outperformed the broader market, rising 7.3% over the quarter.

In the US, the S&P 500 Index advanced 8.0%, led by large-cap technology stocks, while small-caps (Russell 2000) surged 12.4%. The Australian Dollar strengthened against the US currency, reducing returns for Australian investors slightly (S&P 500 in AUD +6.8% and Russell 2000 in AUD 11.1%)

International developed markets were strong, but lagged slightly behind the US equity market, with the MSCI EAFE Index up 4.8% in local currencies (and 3.6% in AUD), held back by more modest performance within the European stock market (3.9% in Euros, 2.8% in AUD).

European markets were weighed down by political instability (e.g., in Germany and France) and fiscal concerns, while global events like potential US government shutdown risks and tariff debates added volatility.

Valuations have risen across the global sharemarkets, and in some sectors and companies, investor confidence has pushed share prices up faster than earnings have grown.

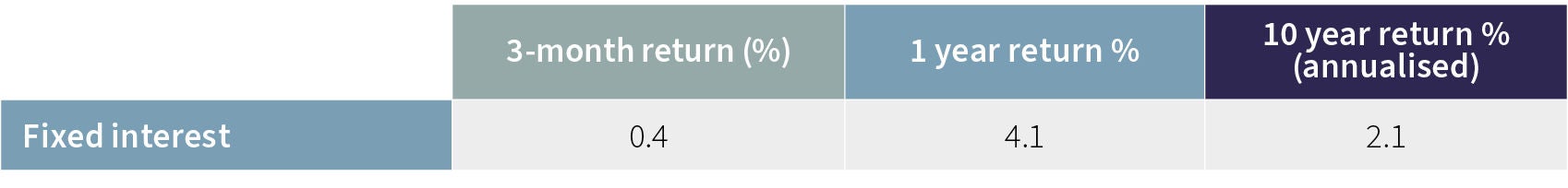

Fixed interest

The Australian fixed interest market delivered modest positive returns of 0.4% over the quarter, amid a backdrop of rising bond yields and more resilient inflationary data. The RBA implemented a single 0.25% interest rate cut in August, bringing the cash rate to 3.60%, but held rates steady in July and September amid an inflation. The RBA’s cautious approach emphasized inflation risks over unemployment risks.

Over the quarter, shorter duration yields rose more sharply than longer term yields – e.g. 3-year government bond yields rose 0.29% while 10-year yields only rose 0.14%. This change in bond yields reflected investors reassessing the speed of near-term RBA rate cuts. The upwards move in yields also partially offset the coupon income of bonds reducing total performance.

Credit sectors performed relatively better, with Australian investment-grade credit spreads tightening (reducing) by 0.16% to 1.0% by quarter-end, supporting stronger returns in corporate fixed income.

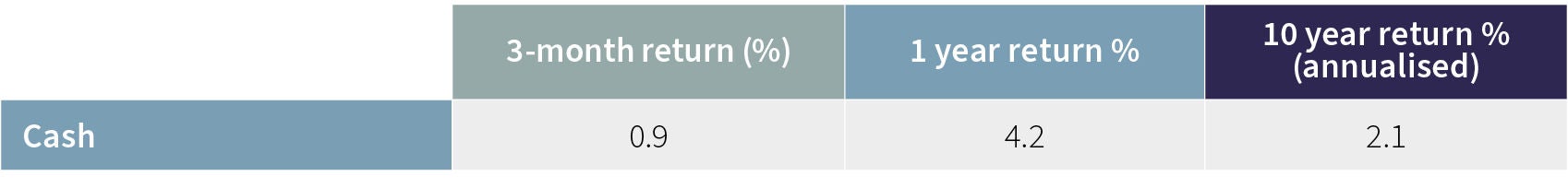

Cash

The official RBA cash level was 3.6% at 30 September. Over the quarter the RBA reduced the official interest rates once by 0.25% in August.

Australia’s economic data has been a mix of positives and negatives. Consumer spending picked up further in July in response to the RBA lowering interest rates earlier in May. However, the labour market disappointed with a small loss in jobs in August. Australia’s annual inflation climbed to 3.0% in August compared to only 1.9% in June. This saw the RBA keep the cash interest rate steady at 3.6% in its September meeting and expressing caution about the slower than expected progress in reducing inflation.