We use cookies to improve your experience on our website. By continuing you acknowledge cookies are being used.

Investment market review - Quarter-ended 30 March 2025

- Title

- Investment market review - Quarter-ended 31 March 2025

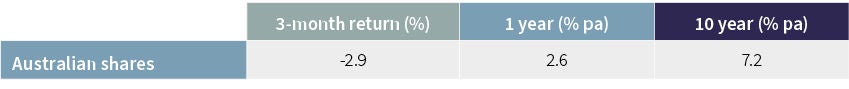

Australian shares

Despite reaching a record high in February, the Australian equity market declined over the March quarter.

Positive economic data, including stabilising inflation modest consumer spending helped support the Reserve Bank of Australia‘s (RBA’)s first interest rate cut this easing cycle. However, negative sentiment from profit taking in US Technology companies and Trump approach to US tariffs on its trading partners weighed on investor sentiment dragged the Australian equity market along with it (-2.9% Q1 2025).

Safe haven sectors outperformed the broader market over the quarter. Telecom Services (+6.7%) and Utilities (+2.2%) delivered positive returns while Consumer Staples protected capital only easing -0.7%. protected capital.

While the Australian IT sector is small relative to the US market, it declined substantially over the quarter (-17.5%), however, the declines for Wisetech (-32.8%) could be considered self-inflicted as the CEO’s messy private life impacted the business.

The Banking sector (-2.1%) outperformed the broader market despite high valuations relative to history and relative to the expected medium term earnings growth expectations.

From a market capitalisation perspective, small caps slightly outperformed their larger counterparts during the 1st quarter (-2.0% v’s -3.0%) supported by more attractive valuations.

Australian listed property trusts

The S&P/ASX 300 A-REIT Accumulation Index declined sharply, led by Goodman Group which is down -20.2% over the quarter and down -15.2% for the year. Goodman had an exceptional Q1 2024, rising +33.6%, which has now rolled out of the annual data. Goodman has also been hurt by the souring global sentiment towards AI and the whether the expected size of expected capital expenditure actually required.

The other key property exposures are broadly higher for the quarter.

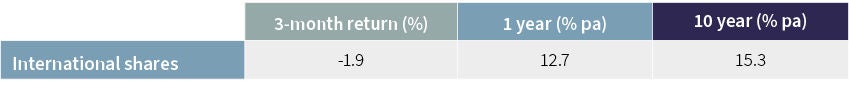

International shares

Global Shares declined during the first quarter of 2025 despite the US making historic highs in February.

US equity investment “exceptionalism” was also questioned as US AI dominance was challenged and developments in Europe and China made their equity markets more attractive to investors. US tariff policy also increased concerns that prices will rise, and the US economy will slow, further reducing the attractiveness of US equities.

The public announcement of the Chinese AI, DeepSeek, it’s competitive score across multiple AI metrics and the relatively low “teaching costs” changed the narrative on AI related companies and raised questions on the significant size of the capital expenditures by large US companies who have been spending billions developing AI capabilities and infrastructure (notably Nvidia, Microsoft, Meta, Alphabet, and Amazon).

The Chinese government has also taken a more pro-business approach to its economic growth and also highlighted their plan to promote “reasonable salary growth” to provide long term support for local consumer conditions. This has caused global investors to re-assess their underweight to the region and the unloved valuations have provided a very attractive entry price and helped the MSCI China Index deliver positive returns over the quarter (+14.3%).

Pressure from the US on Europe and the aggressiveness of the Trump Administration’s approach to peace talks between Ukraine and Russia has led Europe to substantially increase its fiscal spending on its defense and infrastructure capabilities. This has combined with attractive valuations across the region to pique investor interest and also deliver positive returns over the quarter (+9.8%).

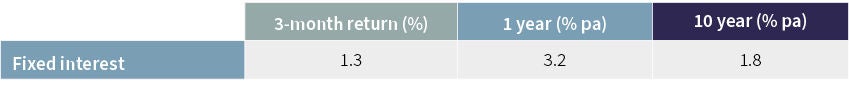

Fixed interest

The RBA joined global peers in the cutting cycle in February, supported by moderating inflation. The CPI trimmed mean (core measure) declined further in February to 2.7% from 2.8% and now resides only slightly above the midpoint of the RBA’s 2 – 3% mandate. Employment dropped by 52,800, well below forecasts of a 30,000 increase, mainly driven by a fall in participation from 67.3 per cent to 66.8 per cent. Unemployment rate remained unchanged at 4.1 per cent.

Supported by declining inflation and concerns over tariffs reducing global and Australian growth expectations, markets started to factor in a more aggressive RBA easing cycle. Chairman Bullock continues to provide guidance that they will monitor inflationary pressures and economic activity and have the ability to continue easing or to delay easing depending incoming data.

Cash

The RBA eased official interest rates by 0.25% to 4.1% in February. The RBA acknowledged that headline inflation has eased substantially, assisted by the government’s Energy Bill Relief rebate. The US tariff policy has raised questions on how it may impact Australia via its major trading partner China and has increased expectations of the number of rate cuts in 2025. RBA believes it is well positioned to support the Australian economy if required but has not signalled intentions on increasing the size of any near term interest rate cuts.

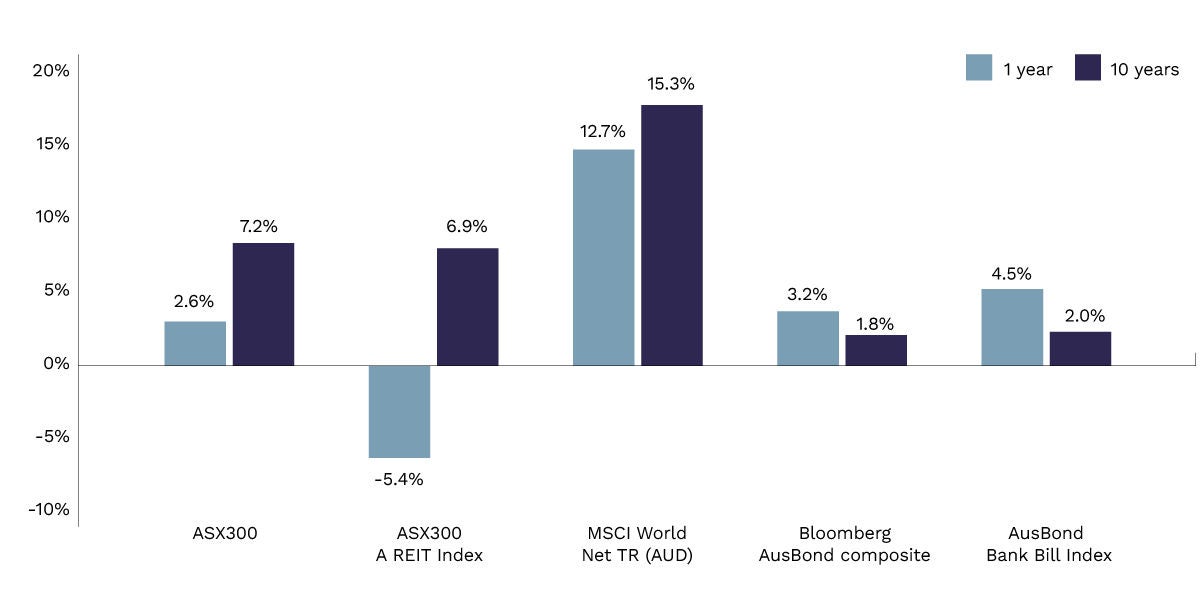

Historical one and ten year returns

The chart below compares one and ten year returns for the major asset classes, as at March 2025.